Buying a car is one of the largest financial decisions many people make, yet few drivers fully understand how quickly a vehicle loses value after purchase. This gap between what a car is worth and what you paid for it can become a serious financial problem if the vehicle is written off or stolen. ALA Gap Insurance is designed to address this exact risk.

This updated 2026 guide explains what ALA Gap Insurance is, how it works, who it is designed for, and when it may not be necessary. The goal is not to sell a product, but to help readers make an informed decision based on real-world ownership risks, current market conditions, and transparent coverage rules.

What Is ALA Gap Insurance?

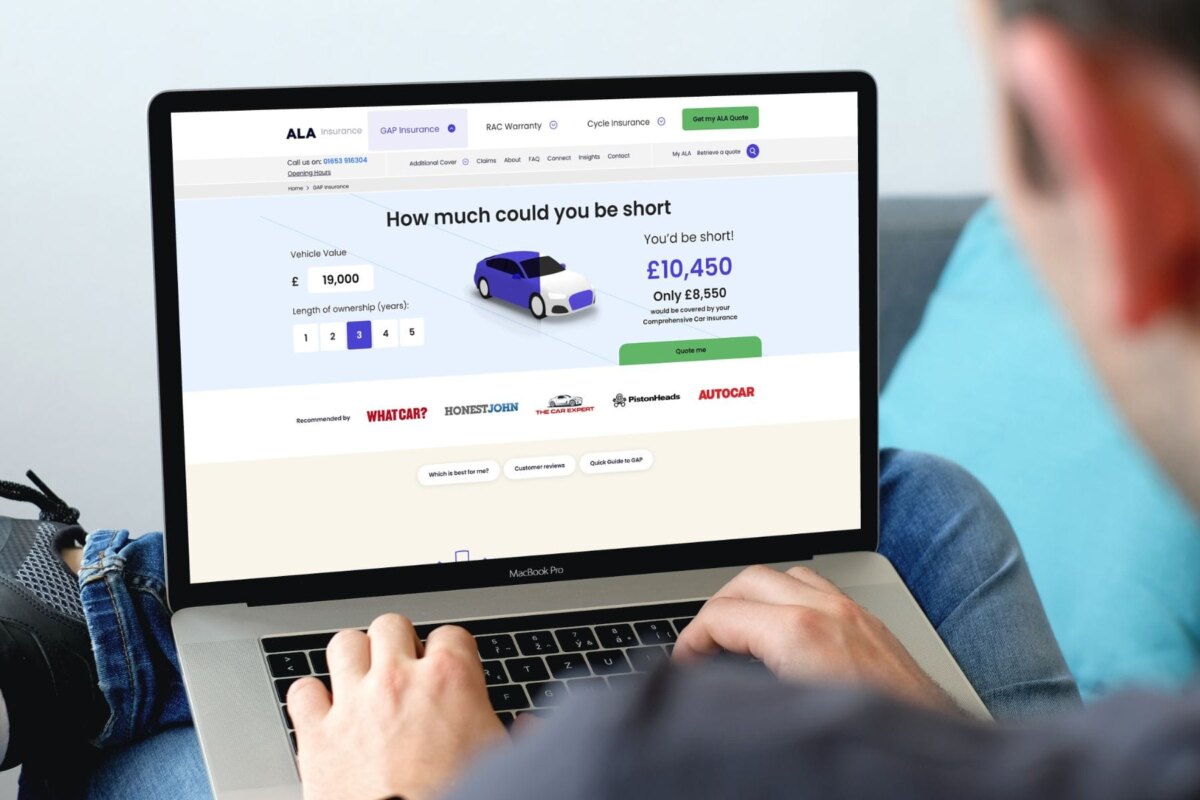

ALA Gap Insurance is a financial protection policy that covers the shortfall between your car insurer’s payout and the original cost or replacement value of your vehicle if it is declared a total loss. Standard comprehensive car insurance only pays the vehicle’s market value at the time of the claim, which is often much lower than the purchase price due to depreciation.

ALA, short for Advanced Loss Assistance, is a UK-based specialist provider that focuses exclusively on GAP insurance. Rather than offering a general insurance bundle, ALA designs policies specifically to protect against depreciation-related losses. This focus allows for clearer policy terms, longer coverage periods, and pricing that is often more competitive than dealership-sold alternatives.

In 2026, with vehicle prices remaining high and depreciation accelerating during the first few years of ownership, GAP insurance has become a practical financial safeguard rather than a niche add-on.

How ALA Gap Insurance Works in Practice

ALA Gap Insurance only applies when your vehicle insurer declares the car a total loss following theft, fire, flood, or severe accident damage. Once your comprehensive insurer settles the claim at market value, ALA covers the remaining eligible gap based on the policy you hold.

For example, if you purchased a vehicle for £28,000 and your insurer later values it at £20,000 after a write-off, ALA Gap Insurance can cover the difference, subject to policy limits. Without GAP insurance, this shortfall would have to be paid personally, even if the incident was not your fault.

This protection is especially relevant for drivers using finance agreements such as PCP or HP, where outstanding balances can exceed the insurer’s payout during the early stages of the contract. ALA Gap Insurance helps prevent drivers from continuing to pay for a car they no longer have.

Types of ALA Gap Insurance Policies Explained

ALA Gap Insurance offers multiple policy types to suit different ownership situations. Choosing the correct policy is essential, as each one protects a different type of financial risk.

Return to Invoice (RTI) Gap Insurance covers the difference between the vehicle insurer’s settlement and the original invoice price you paid. This option is commonly chosen for new and nearly new vehicles where early depreciation is most severe.

Vehicle Replacement Gap Insurance protects against price inflation by covering the cost of replacing your car with a brand-new equivalent model if replacement prices increase. This can be particularly valuable during periods of market volatility.

ALA also provides Contract Hire Gap Insurance for leased vehicles and Agreed Value Gap Insurance for older or specialist cars. Each policy is clearly defined, allowing buyers to match cover precisely to their financial exposure rather than paying for unnecessary protection.

ALA Gap Insurance vs Dealership GAP Policies

Many drivers are offered GAP insurance at the point of purchase by a dealership, but these policies often come with higher costs and limited flexibility. Dealership GAP insurance typically includes commission-based pricing and shorter policy durations.

ALA Gap Insurance is purchased independently, which allows:

- More transparent pricing

- Longer policy terms, often up to five years

- Clear documentation provided before purchase

- No pressure-based sales environment

Following regulatory changes in the UK GAP insurance market, consumers are now more aware of the importance of comparing providers. ALA’s independent structure aligns well with this shift, giving buyers more control and clarity over their coverage.

Is ALA Gap Insurance Worth It in 2026?

Whether ALA Gap Insurance is worth it depends on how much financial risk you carry if your car is written off. For many drivers, particularly those with new or financed vehicles, the answer is yes.

ALA Gap Insurance is most valuable during the first few years of ownership, when depreciation is highest and finance balances are still significant. In 2026, rising vehicle prices and unpredictable replacement costs have increased the potential financial impact of a total loss.

However, drivers who purchased an older vehicle outright at a low price may find that the potential gap is minimal. In such cases, GAP insurance may offer limited benefit. The key factor is not the car itself, but the size of the potential financial shortfall.

What ALA Gap Insurance Covers and What It Does Not

ALA Gap Insurance is designed to complement comprehensive car insurance, not replace it. It focuses solely on financial loss resulting from depreciation.

Typically covered situations include:

- Total loss following an accident

- Vehicle theft where the car is not recovered

- Fire or flood damage leading to a write-off

ALA Gap Insurance does not cover:

- Mechanical or electrical failures

- Routine wear and tear

- Minor accident repairs

- Claims where no valid comprehensive insurance payout exists

Understanding these boundaries is essential. ALA clearly outlines exclusions, mileage limits, and eligibility requirements, which helps avoid confusion at the claims stage and supports informed purchasing decisions.

Claims Process and Practical Experience

When a claim occurs, the process begins only after your primary insurer has confirmed a total loss and issued a settlement figure. This ensures that GAP insurance remains a secondary layer of protection rather than overlapping coverage.

Once documentation is submitted, ALA reviews the claim against policy terms and calculates the eligible gap amount. Payments are typically made directly to the policyholder or finance provider, depending on the situation.

Clear documentation requirements and defined claim steps help reduce uncertainty during an already stressful time. This operational clarity is an important consideration when choosing a GAP insurance provider.

Regulation, Trust, and Consumer Protection

ALA Gap Insurance is FCA-authorised and regulated in the UK. This regulatory oversight ensures that policies are sold fairly, information is clearly presented, and customers have access to formal complaint and dispute-resolution processes.

In financial products such as insurance, regulation plays a critical role in protecting consumers. FCA authorisation means that ALA must meet strict standards around transparency, pricing, and customer treatment.

Independent ratings and customer feedback further contribute to trust signals, helping buyers evaluate the provider beyond marketing claims alone.

Who Should Consider ALA Gap Insurance?

ALA Gap Insurance is particularly suitable for:

- New or nearly new car buyers

- Drivers using PCP, HP, or lease agreements

- Owners of high-value vehicles

- Drivers planning to keep a vehicle for several years

It may be less suitable for:

- Low-value vehicles purchased outright

- Cars with minimal depreciation remaining

- Short-term ownership with limited financial exposure

Assessing your own risk profile is essential. GAP insurance is not a universal requirement, but for the right buyer, it can prevent significant financial loss.

Final Assessment: Is ALA Gap Insurance a Sensible Choice?

In the current automotive and financial landscape, ALA Gap Insurance offers a clear, focused solution to a well-defined problem: depreciation-related loss. Its specialist approach, transparent policy structures, and regulatory oversight make it a practical option for drivers who face meaningful financial exposure.

Rather than viewing GAP insurance as an unnecessary extra, many consumers now see it as a strategic extension of comprehensive car insurance. For financed vehicles and higher-value purchases, ALA Gap Insurance can provide reassurance and financial stability when unexpected events occur.

You may also read: Fire Safety and Downlight Covers: Why They’re Essential