If you’ve ever asked yourself, “What does a bank statement look like?”, you’re not alone. A bank statement is an official document that records all activity in your account over a specific period, usually a month. Understanding what a bank statement looks like is crucial for managing finances, monitoring spending, and detecting errors or fraud.

In this guide, we’ll explain what a bank statement looks like, break down its key sections, show how to review it, and provide practical tips for using it to improve your financial health.

What Does a Bank Statement Look Like? The Basics You Should Know

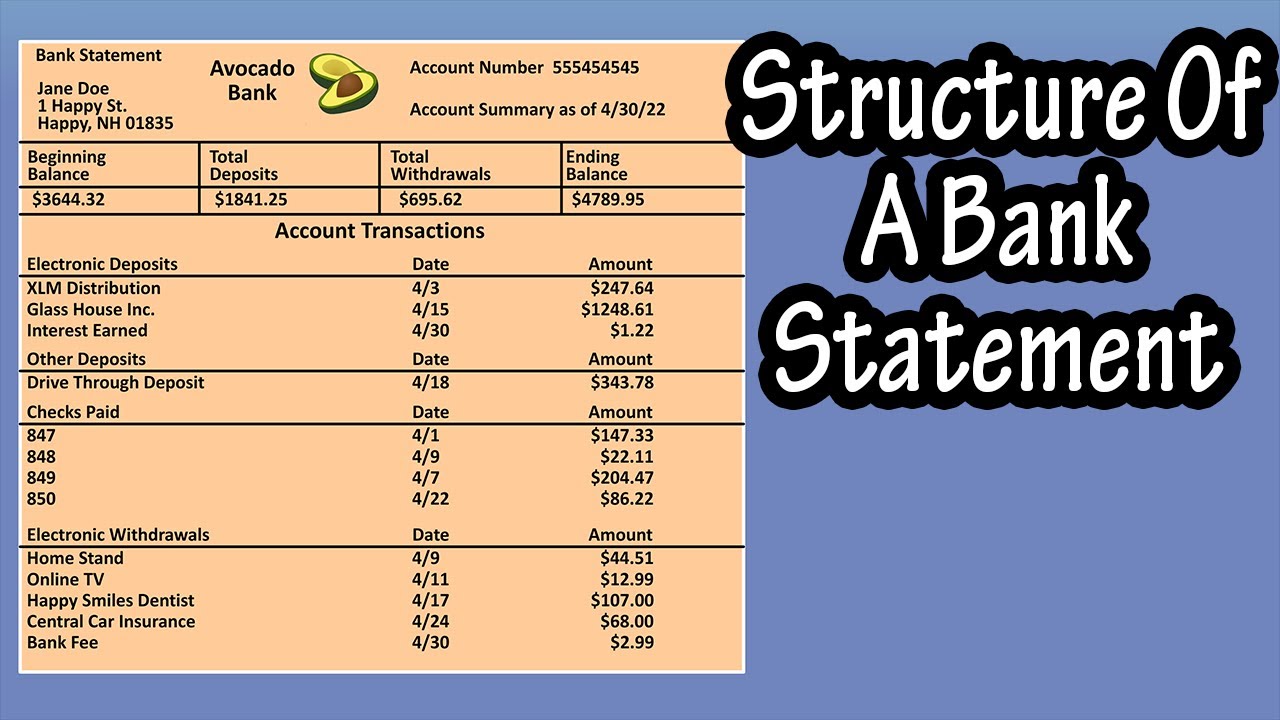

When asking what a bank statement looks like, it’s important to know that most statements follow a similar structure. They provide a summary of deposits, withdrawals, fees, interest earned, and account balances.

Bank statements can be paper-based or digital PDFs. Digital statements often include interactive features such as filtering transactions, exporting records, and receiving notifications. Understanding what a bank statement looks like ensures you can track your finances accurately and avoid missing any important details.

Key Sections: What Does a Bank Statement Look Like Inside?

Knowing the sections of a bank statement is essential. Here’s what you’ll typically find:

1. Account Information

Every statement starts with personal and account details, including your name, address, account number, and the type of account. Most banks also include their contact information at the top.

If you’ve wondered what a bank statement looks like in this section, this part ensures clarity and accuracy by clearly identifying your account.

2. Statement Perio

The statement period indicates the start and end dates. This section frames all transactions in that timeframe. Knowing what a bank statement looks like regarding the period helps you track monthly spending trends and compare activity over time.

3. Opening and Closing Balances

The opening balance is your account total at the start of the period, and the closing balance is what remains at the end. Understanding what a bank statement looks like in terms of balances allows you to evaluate income, expenses, and overall financial health.

4. Transaction Details

The transaction section lists every deposit, withdrawal, transfer, and fee. Each entry includes the date, description, and amount.

If you’re visualizing what a bank statement looks like in the transaction section, imagine a detailed table showing all activity, helping you track every dollar in and out of your account.

Modern Bank Statements: Digital Features

If you’ve asked what a bank statement looks like today, digital statements often include features such as:

- Viewing real-time transactions.

- Downloading PDFs for record-keeping.

- Receiving alerts for large or unusual transactions.

- Exporting records to budgeting or accounting software.

Understanding what a bank statement looks like digitally gives you better control over your finances and ensures nothing is overlooked.

How to Read a Bank Statement Effectively

Knowing what a bank statement looks like is only the first step. Here’s how to read it properly:

- Verify your account and personal information.

- Check the statement period.

- Compare opening and closing balances.

- Review all transactions for accuracy.

- Identify fees or charges.

- Look for unusual or suspicious activity.

By following these steps, you’ll fully understand what a bank statement looks like and avoid errors or fraud.

Using Bank Statements to Manage Your Money

Understanding what a bank statement looks like allows you to use it as a tool to manage your finances effectively:

- Budgeting: Categorize spending to see where your money goes each month.

- Loan or Rental Applications: Provide proof of income and account activity.

- Fraud Detection: Spot unauthorized transactions before they become a problem.

- Savings Planning: Track income and expenses to set realistic savings goals.

Knowing what a bank statement looks like also helps you make smarter financial decisions each month.

Paper vs. Digital Statements

If you’re wondering what a bank statement looks like in different formats, here’s a quick comparison:

- Paper Statements: Tangible, easy to file, but slower and less secure.

- Digital Statements: Faster, secure, eco-friendly, with features to search, download, and track activity efficiently.

How Long Should You Keep Bank Statements?

Knowing what a bank statement looks like can also guide storage and record-keeping. Review statements monthly, keep them at least a year for reference, and retain them for up to seven years for tax or legal purposes. Digital backups are recommended for convenience and security.

FAQs: What Does a Bank Statement Look Like?

Q1: Can I access my bank statement online?

Yes. Most banks provide access through online portals or mobile apps, allowing you to see exactly what a bank statement looks like anytime.

Q2: Can a bank statement serve as proof of income?

Yes. Statements showing deposits and balances are accepted for loans, rentals, or financial verification.

Q3: What should I do if I spot an error?

Contact your bank immediately. They have procedures to correct errors or investigate unauthorized transactions.

Q4: Are electronic statements safe?

Yes, when accessed through official banking platforms. Understanding what a bank statement looks like electronically ensures you handle it safely.

Q5: How often should I review my bank statement?

Monthly reviews are recommended to track spending, detect fraud, and monitor balances. Knowing what a bank statement looks like each month keeps you in control.

Conclusion

If you’ve ever asked “What does a bank statement look like?”, now you have the answer. A bank statement provides a detailed overview of your account activity, including balances, transactions, and fees. By understanding what a bank statement looks like, you can budget effectively, detect errors or fraud, and maintain strong financial health.

Whether paper or digital, reviewing statements regularly ensures you stay informed and in control. Knowing what a bank statement looks like empowers you to make better financial decisions and protect your account from errors or unauthorized activity.

You may also read: How to Use the Green Belt Map UK 2025